Card Issuing

- Home

- Card Issuing

Launch Branded Cards - Fast, Secure & Customizable

Issue virtual or physical debit cards under your brand – powered by secure APIs, built-in compliance, and bank partnerships.

Why Card Issuing Matters

Card Issuing lets you deliver branded payment cards – virtual or physical – without owning the infrastructure. FinLego’s platform enables fintechs and crypto businesses to issue, manage, and control card programs through modern APIs and compliant back-end systems.

It removes the complexity of connecting to networks (Visa, Mastercard), handling security, managing compliance, and operating issuance logistics – all while maintaining full brand ownership and control over the user experience.

Deliver and Manage Cards as Part of Your Financial Stack

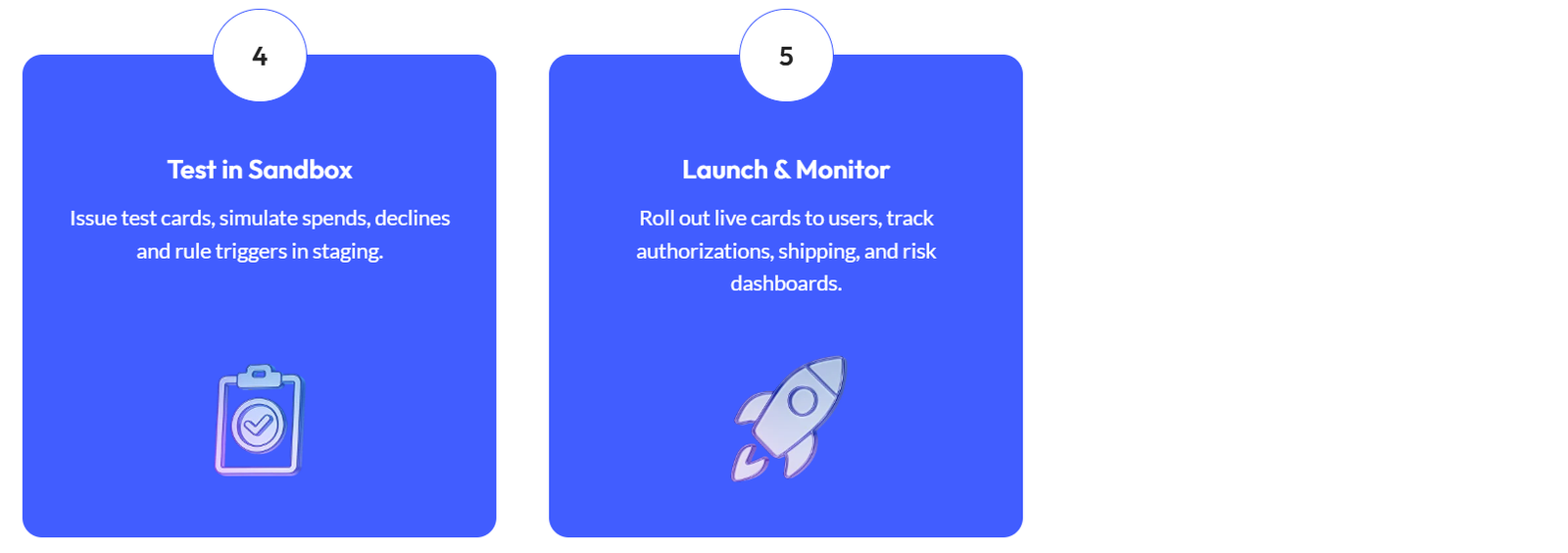

Virtual & Physical Cards

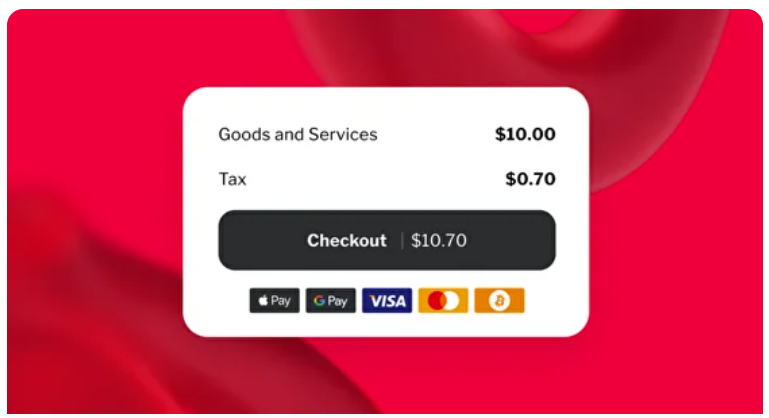

Issue digital cards for instant online use and physical cards for in-store spend, with your branding across platforms. Support EMV, contactless payments, and mobile wallet tokens.

Card Design & Control

Customize card artwork, spending categories, PINs, and tokenization settings. Set spend limits, merchant restrictions, and dynamic CVV rules - configured per card or user segment.

Multi-Currency Support

IIssue cards tied to different underlying currencies. Combine with wallet balances for automatic currency selection and FX flows - ideal for global users.

Instant Issuance via API

Enable users to generate virtual cards instantly - ready for digital spend or tokenization in Apple Pay or Google Pay. Issue physical cards via fulfillment partners with real-time status updates.

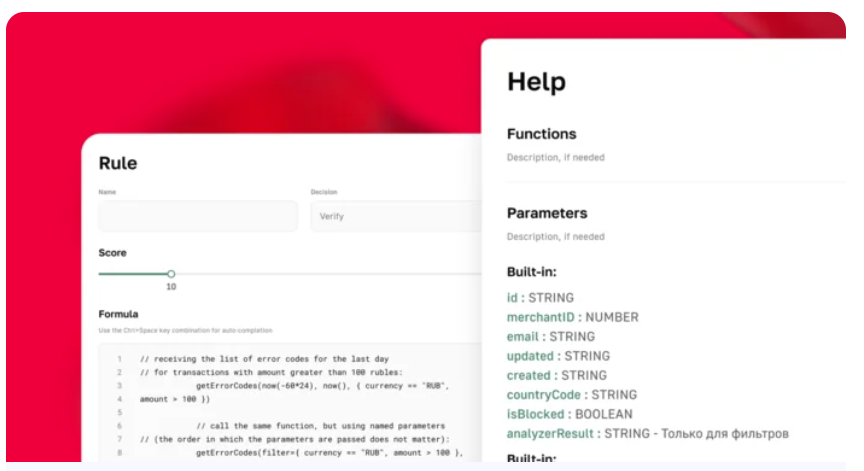

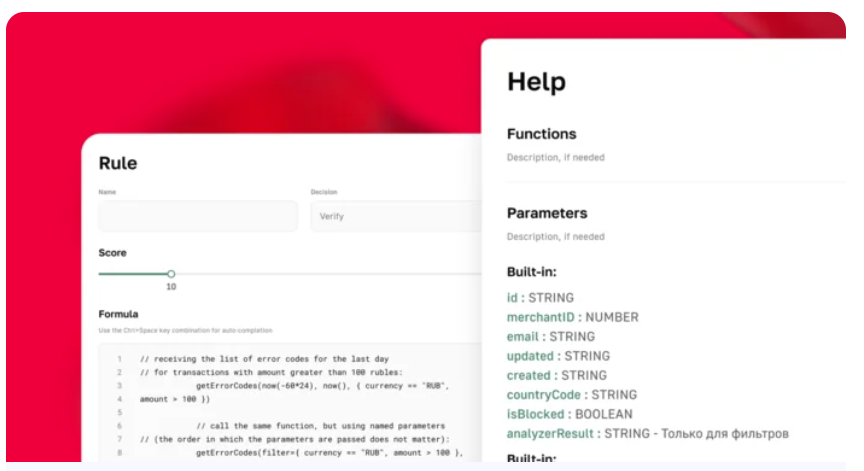

Fraud & Authorization Rules

Apply real-time fraud detection, geolocation controls, velocity thresholds, merchant category controls, and authorization routing - either to decline, hold for review, or approve.

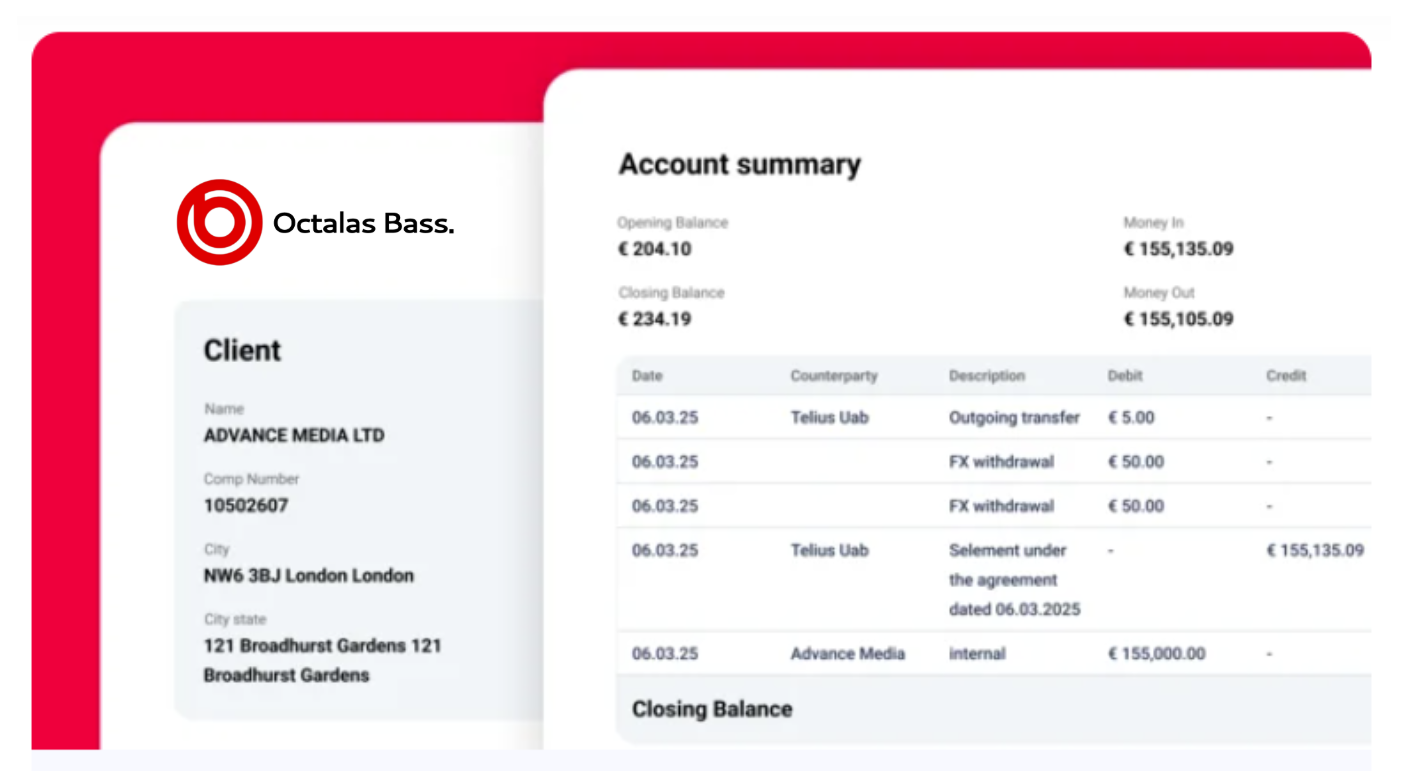

Integrated Ledger & Billing

Each card transaction auto-posts to your ledger. Fees, currency markups, and refunds are tracked and billed automatically - no manual reconciliation needed.

Compliance & KYC Integration

Linked with Octalas’s KYC/AML tools. Only KYC-KYB verified users can receive cards. All card-related actions adhere to issuer and scheme-level compliance rules.

Ideal Use Cases for Card Issuing

Branded Card Capability Without the Complexity

Speed to Market

Skip scheme approval and technical integration delays - launch card programs in weeks using our API and trusted partner connectors.

Cost-Efficient Card Issuance

Avoid building your own issuing stack. Pay for usage with modular pricing - virtual or physical cards, processing and fulfillment all included.

Multi-Rail & Multi-Currency Issuing

Out of the box, you can configure how to record wallet top-ups, cross-currency conversions, commissions, partner payouts, and more.

Full Control Over Customer Experience

Your design, your UX, your rules - down to card limits, CVV policies, and customizing spend categories. The card looks and feels like yours.

Compliance Built-In

Issuer license, PCI-DSS aligned infrastructure, KYC/KYB integration, sanction checks - compliance isn’t an afterthought, it’s embedded.

Built-in Risk & Fraud Logic

Configure fraud rules and authorization logic without coding new modules. Monitor declined transactions, velocity spikes, and abusive behavior in real time.

Structured & Secure by Design

Secure Card Handling

- EMV-compliant card issuance

- Tokenization (Apple Pay, Google Pay)

- Dynamic CVV, PIN rules, secure customer data management

Fraud & Transaction Protection

- Real-time detection of unusual spend patterns

- Velocity and geolocation controls

- Merchant category spending restrictions

Compliance Infrastructure

- KYC/KYB gating before card issuance

- PCI-DSS support via our licensed partners

- Full audit logs for all reversals and authorization events

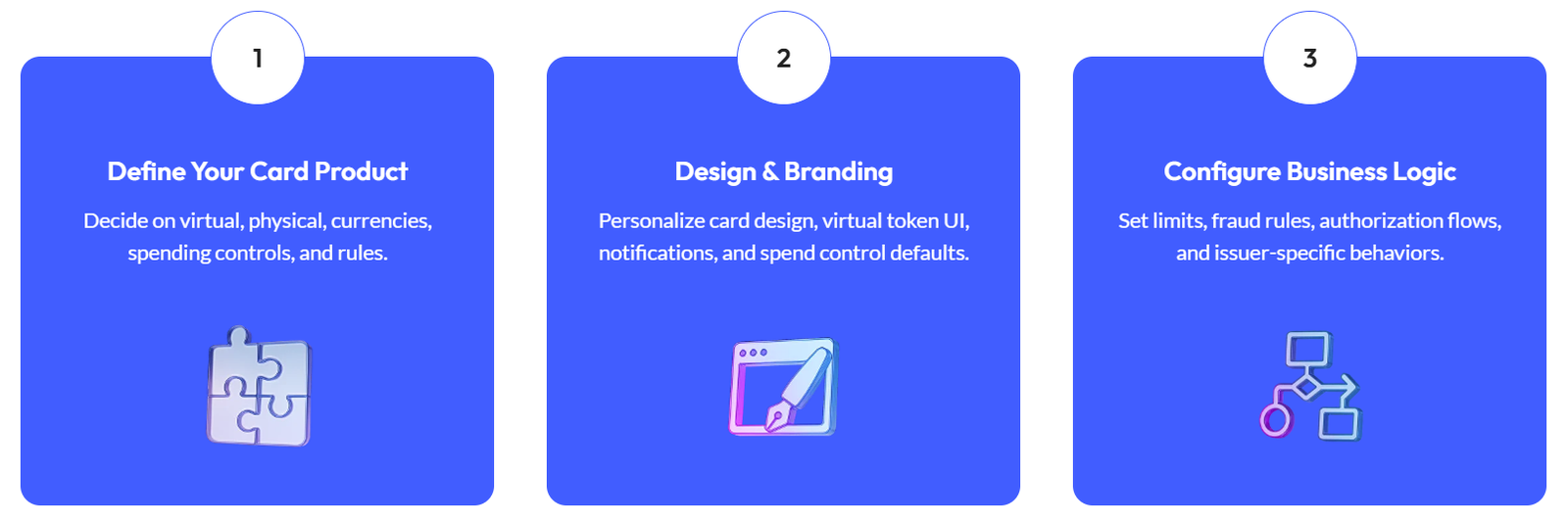

Card Issuing Program in Action - 5 Steps